If you would like to get in contact with us so that we can provide you with an offer to buy your house, please fill out the form to the right on this page and someone on our team will reach out to you as soon as possible to discuss. You may also call us directly at (405) 867-7625.

On this page, you will read about some common reasons why someone might want to sell their home for cash quickly. It is our mission to provide “Solutions with Integrity” to anyone who finds themselves in a situation where they might say “I need to sell my Oklahoma City area home fast!” We promise to do everything in our power to come up with a solution that works for everyone involved. We also promise to treat you fairly throughout the process. We never charge any fees or commissions on anything and will pay all closing costs that would usually be paid for by the seller.

There is an abundance of public information available to those who know how to find it (or who pay subscription fees for it) that includes financial standing of real estate loans and/or the owners of such property. Any solution we come up with will include Integrity, which is basically our promise to you to come up with a win-win solution and not take advantage of your situation based on any public information available. Sometimes this win-win situation will be something you will be excited about, and other times it may not meet your desires even though it might still be beneficial for all of us. If we feel like the price we could offer would not be to your advantage, we may be able to direct you in the right direction even if it does not result in selling your house for cash to us.

Here are the top two reasons why you might want to sell your home for cash quickly:

-

Convenience – you are ready to move, but dread making the repairs, keeping the house clean, as well as all the other steps required to get your house (or the house of a loved one) ready to sell on the open market. You value the flexibility, lack of disruption, and overall time you will save by having a quick and easy transaction. We can offer a fair “as-is” price for your house and provide flexibility with closing date.

-

Financial Distress – sometimes things don’t turn out the way you had hoped, and the best thing to do in those cases is to limit the damage and come up with a new plan for future success. If you are behind on your mortgage payments, have received a notice of foreclosure, or could use some extra cash to pay off other debts, selling your home quickly for cash might make sense for you. With items involving your credit (such as missed payments and risk of foreclosure), the faster you act to correct it, the better. Bad credit will limit your future options on things like credit cards, mortgages, and other loans, and will result in higher rates that could end up costing you tens of thousands of dollars more in interest while you build back your credit. Many people who are in this situation do not have the funds available to properly repair and prepare their house for sale on the open market, so a cash offer could make sense for you if you find yourself in this situation.

At StableRock, we make it our mission to help each family who we buy a house from even after the transaction. We do this by offering complimentary financial advice from a CPA that can cover any areas you might find beneficial, whether that is developing a budget, developing a plan to pay off debt, or general financial education. This is not an eBook that we send to you, this is one-on-one time to address your specific situation that we refer to as our “Shining Light” program. We want to buy your house, but we also want to make sure to set you on the right path so that you can be a homeowner again one day and/or accomplish any other financial goals you may have as well. The “Shining Light” program is entirely optional.

There are plenty of other reasons you might want to sell your home fast for cash. No matter what your motivation is, we are here to help! Submit the form on the right and someone on our team will reach out to you as soon as possible to discuss.

Other reasons why you might want to sell your home for cash:

-

Deferred Maintenance: For whatever reason, you haven’t fixed things as they have needed repairs. This could be large items such as an air conditioning unit or tile cracking due to a foundation issue, or smaller items such as filthy carpet or walls that need a fresh coat of paint. Regardless of the item or the number of items that need to be repaired, you just either can’t afford the repairs or can’t get motivated to do anything about it. A house will only be livable for so long without proper maintenance, so if you would rather “trade it in” and let someone else deal with it while you move on to the next one, we can buy your house from you as-is so that all of your maintenance problems now become our maintenance problems! Similar to trading in a car, selling your house for cash to us might be the most appealing option for you so that you don’t have to worry about preparing your house for sale and doing the repairs required in order to sell it.

-

Inherited House: A loved one has recently died and left you, or you and other(s), their home as part of an inheritance. Depending on how well those who inherited a piece of the property get along, you might want to sell this house fast for cash, so that you can split the proceeds. There are other options available, such as renting the house to either someone who has inherited a piece of it or someone you do not know. However, this will involve a continued financial relationship with other family member(s) unless you are the sole heir to the property, or you can buy the other(s) out so that you own 100% of it. For some families, this ongoing financial relationship can be a scary thought. In these cases, the quickest way out is to sell your home fast for cash!

-

Mortgage Forbearance: During the COVID pandemic, mortgage forbearance became a popular option for homeowners who would have otherwise had trouble paying the mortgage on time. Under this program, mortgage payments could be missed, but the amounts were not forgiven. Instead, they are simply paid at a later date. Two popular options were for any payments that were missed to be made up either by increased monthly payments at the end of the forbearance period, or by adding months at the end of the original mortgage term. In any case, your situation now is likely different than it was prior to entering into a forbearance agreement, otherwise you would have kept making the mortgage payments as usual. If your new mortgage payment amount at the end of the forbearance period will be more than you can afford, it could be advantageous to sell your home for cash before this results in a financial hardship.

-

Reduce Your Debt to Income Ratio (DTI) Before Closing on A New House: You have found the perfect home, and all that remains is to find a way to get out of your current home so that you can buy it! In a perfect world, you would be able to buy the new home, then put your current home on the market, leisurely move into your new home, and then sell your old home. However, reality is usually nowhere close to this scenario! In fact, depending on your DTI ratio, you might not qualify to purchase the new home until you have sold the old home. Do you simply put your home up for sale hoping that it sells quickly, before someone else buys your dream home? That is a risk that may or may not pay off. Alternatively, you could call us for a cash offer on your home and choose your closing date! You could then quickly lock in that new home you have your eyes on and we can close on your existing home right BEFORE you have to close on your new home, creating a situation where you do not have to qualify to have both mortgages at the same time. To better explain, here is an example of how this affects DTI: You have a mortgage payment of $1,000 on your current home, and the new home would require a $1,250 mortgage payment. You have other loans that add up to $800 per month. You make $5,000 per month in gross income (before taxes). Without first selling your existing home, your DTI ratio would be ($1,000 + $1,250 + $800)/$5,000, or $3,050/$5,000, which is 61%. If you were able to get your existing home out of that calculation by selling it first, your DTI would then be ($1,250 + $800)/$5,000, or $2,050/$5,000, which is 41%.

Many lenders place a limit on DTI of between 40-50%, so you can see how having two homes at once might affect your ability to qualify. We advise you to ask your lender what their requirements are to see if this will be an issue for you. Here is a detailed article about DTI: Debt-to-Income Ratio (DTI): What It Is and How to Calculate It | The Truth About Mortgage

-

Divorce: Most married couples combine their finances at least to some extent, and so it is natural that both spouses are usually on the title of a house purchased together. When going through a divorce, this can present problems. Oftentimes, the easiest way to split the house is to sell it. In these cases, we can purchase your home for cash so that you can easily divide the proceeds and may even be able to arrange for one of you to rent the home back from us after we buy it. Some people want to live in the same home after a divorce, and for others it brings back memories. We like to offer you options, whether that involves selling your home and being done with it, selling it to us and one spouse renting it back, or even just a referral to a marriage counselor!

-

Avoiding Tough Decisions: Your brother is a real estate agent, but so is your brother-in-law. Who gets to sell your home? Ok, we’re joking a bit here, but the point is that regardless of what your reason is for wanting to sell your home for cash, we can help!

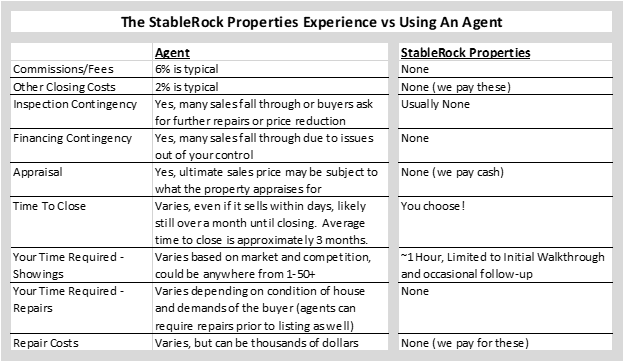

Whether or not selling your home for cash would be better for you than listing it with an agent depends on many factors, including the length of time you have to close on the sale, the condition of the house, and the value you place on certainty and flexibility. We buy Oklahoma City area homes for cash, but our services are not for everyone. Below is a good comparison of what you can expect when selling you home to us vs listing it with an agent:

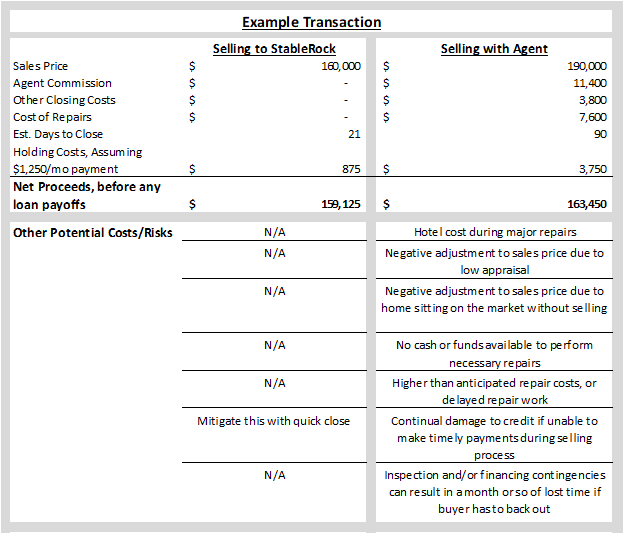

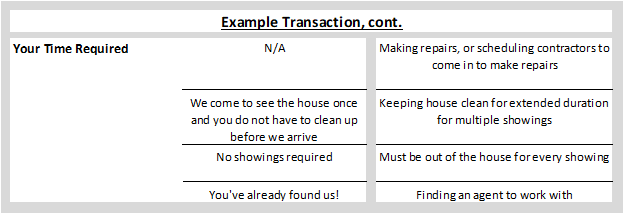

To illustrate what these savings might look like, and what an overall transaction might look like when selling your home for cash compared to selling with an agent, please see the example transaction below. It is impossible to know which option would be best for your individual situation since there are always multiple things to consider, some financial and some other. Calling us to schedule a walkthrough so that we can give you an offer is step 1 to making an informed decision.

*The above is a theoretical transaction only, the difference in price you can get from selling to StableRock and selling with an agent is different for each transaction. Your "Sales Price" will always be lower when selling to StableRock (or any other "we buy homes for cash" company), but our ultimate goal is for the "Net Proceeds" that you receive to be close to your "Net Proceeds" when selling with an agent, and any difference to be made up via reduced risk and time required to sell with an agent vs selling your home for cash to StableRock. There is considerable value in certainty.

Our Process:

The process of selling your home for cash to StableRock is simple, and we will describe it below:

-

You contact us via a form on our website or by calling us at (405) 867-7625 to ask any initial questions and to schedule a time for us to come out and take a look at your house. We will gather some information from you about your house prior to coming out to see it. This information will include the basics such as address, square footage, and any liens currently on the property.

-

We will do some research on our end that will help to determine the potential value of your home after any repairs and renovations have been completed, and then come out to view your home to determine the overall condition as well as note any items that need to be repaired. Please allow an hour or so for us to view your home.

-

We will send you a cash offer for your house within 48 hours of when we view it. This allows us time to properly value your home instead of giving you an offer on site which would often result in undervaluing your home due to conservative assumptions being made in the absence of additional time to come up with a fair value. Please note that if you absolutely desire an offer while we are on site, we can accommodate you, though we would advise against this regardless of whether it is with us or another cash buyer.

-

Our offer is good for 48 hours after you receive it. If you choose to accept the offer, we will begin to arrange for a closing date based on what works best for you and work with the title company (at no cost to you – remember, we pay closing costs).

-

Once we have a closing date set, you make arrangements to move out of your home prior to that date. Then, we will close the transaction with a title company which will transfer the ownership from you to us. That’s it, you are now done! At this point, you can schedule your complimentary financial education appointment as part of our “Shining Light” program, if desired.